does doordash report income to irs

But if filing electronically the deadline is March 31st. The 600 threshold is only for mandating a company send a 1099 form to an.

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Its mainly for IRS statistics and doesnt affect what you owe.

. Yes all income is considered taxable by the IRS. DoorDash drivers are not full-time employees of the company which means that DoorDash does not withhold taxes from your income. DoorDash drivers are not full-time employees of the company which means that DoorDash does not withhold taxes from your income.

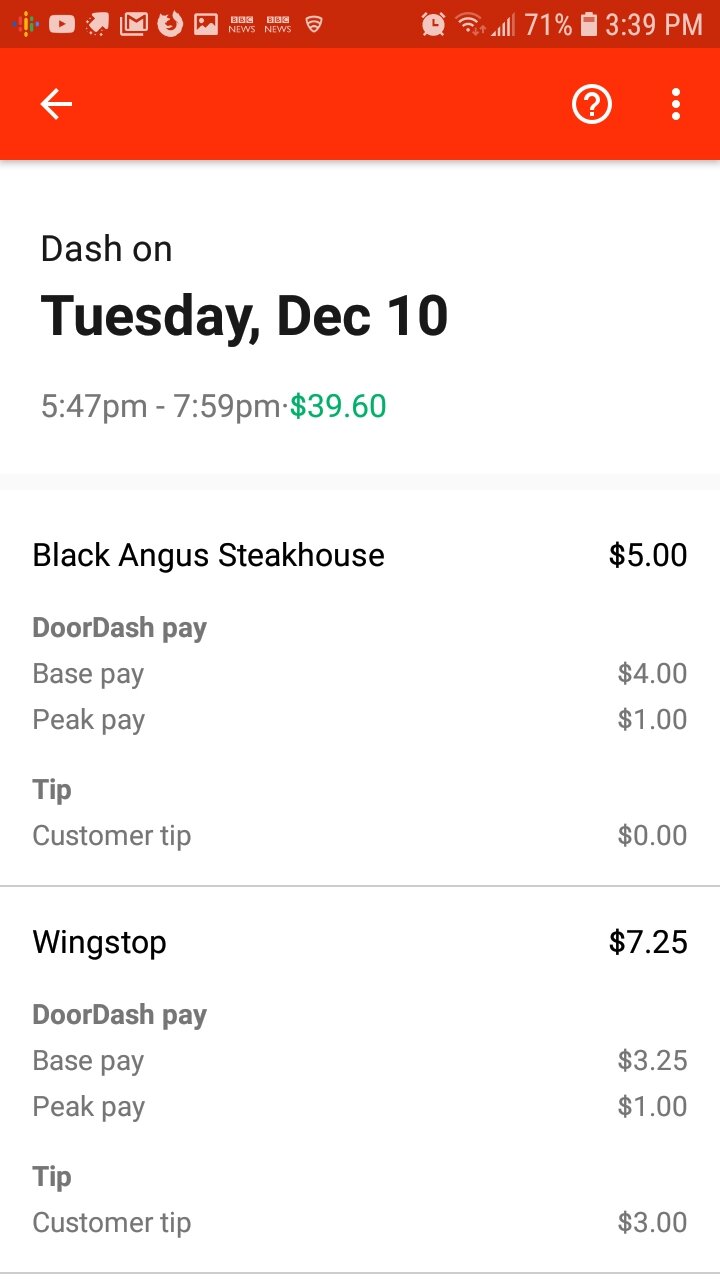

Yes - Cash and non-cash tips are both taxed by the IRS. Posted by 27 days ago. In the United States all Dashers that earn 600 or.

You do have the. You do not get quarterly earnings reports from dd. Does DoorDash send you a W2.

Since dashers are treated as business owners and employees they have taxes. Does DoorDash issue a 1099. Here you will add up how much money you received for your delivery work.

Do I need to report DoorDash income if it is less than 600. DoorDash usually sends a 1099 to its drivers to keep track of their earnings to the IRS. Yes - Cash and non-cash tips are both taxed by the IRS.

Federal income taxes apply to Doordash tips unless their total amounts are below 20. Log into your checking account every pay day and put at least 25 of your dd earnings in savings. Doordash does not provide.

Does DoorDash report income to State or just IRS. Your cash tips are not included in the. DoorDash does not take out withholding tax for you.

In this way Does DoorDash. January 31 -- Send 1099 form to recipients. This is a flat rate for gig work so youll pay the same.

Dashers are self-employed so they will pay the 153 self-employment tax on their profit. Income tax on the other hand is based on the combination of all forms of income. How does Instacart report wages.

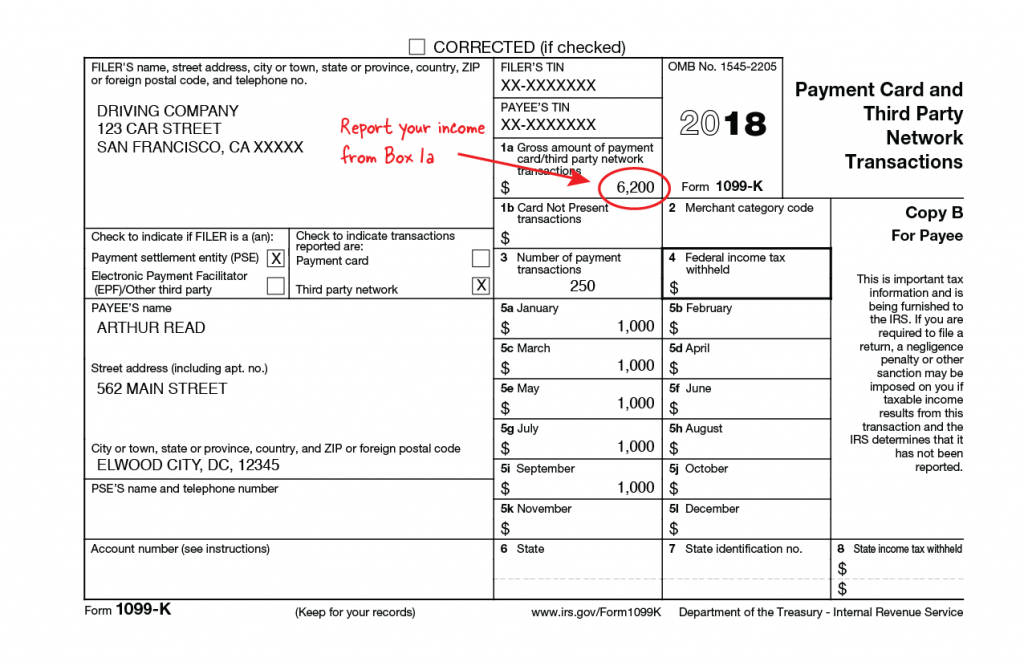

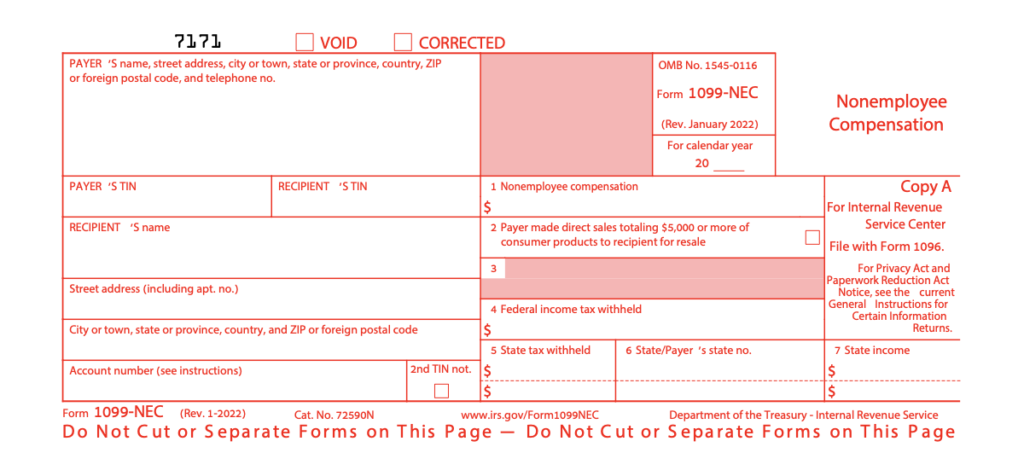

The forms are filed with the US. A 1099-NEC form summarizes Dashers earnings as independent contractors. Once you receive the 1099 form and file the taxes you need to report the exact figure as the overall income to the IRS.

You should report your income immediately if. DoorDash can be used as proof of income. According to the IRS independent contractors need to report and file their own taxes.

Doordash considers delivery drivers to be independent contractors. The forms are filed with the US. Beginning with the 2020 tax year the IRS requires DoorDash to report Dasher income on the new Form 1099-NEC instead of Form 1099-MISC.

March 31 -- E-File 1099-K forms with the IRS. What Are The Doordash Tax Documents. At the end of every quarter add up your.

Does DoorDash issue a 1099. January 31 -- Send 1099 form to recipients. Does DoorDash report income to State or just IRS.

Dashers pay 153 self-employment tax on profit. Yes DoorDash does report its dashers earnings to the IRS since it provides its drivers with 1099-NEC forms. February 28 -- Mail 1099-K forms to the IRS.

How Do I Apply For Unemployment Benefits With DoorDash. Internal Revenue Service IRS and if required state tax departments. Does DoorDash issue a 1099.

Depending on who is asking there are several different ways you may need to.

Pro Door Dasher Shares Tips To Maximize Your Earnings

No Free Lunch But Almost What Doordash Actually Pays After Expense Payup

Pro Door Dasher Shares Tips To Maximize Your Earnings

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

How To Report Wages For Door Dash If It Includes Tips Quora

15 Must Know Doordash Driver Tips 2022 Make More As A Dasher

Doordash Tax Deductions Maximize Take Home Income

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Got Hidden Income The Irs May Get More Money To Find You Wsj

How Do Food Delivery Couriers Pay Taxes Get It Back

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Tips For Filing Doordash Taxes Silver Tax Group

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Reporting 1099 Delivery Driver Income On Your Taxes In 2022

How Do Food Delivery Couriers Pay Taxes Get It Back

Freelancers 4 Tax Forms You Ll Receive This Tax Season

Doordash 1099 How To Get Your Tax Form And When It S Sent

Taxing The Gig Economy Congress Made An Improvement But More Reforms Are Needed